"In the end, only three things matter: how much you loved, how gently you lived, and how gracefully you let go of the things not meant for you." Jack Kornfield

Nasdaq Charm:

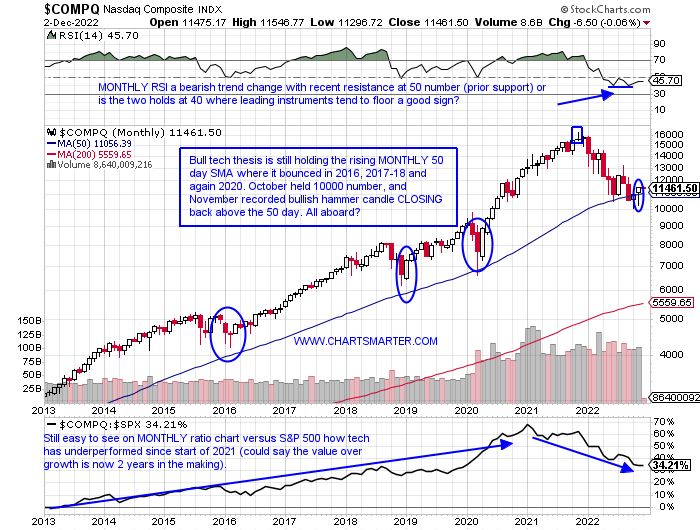

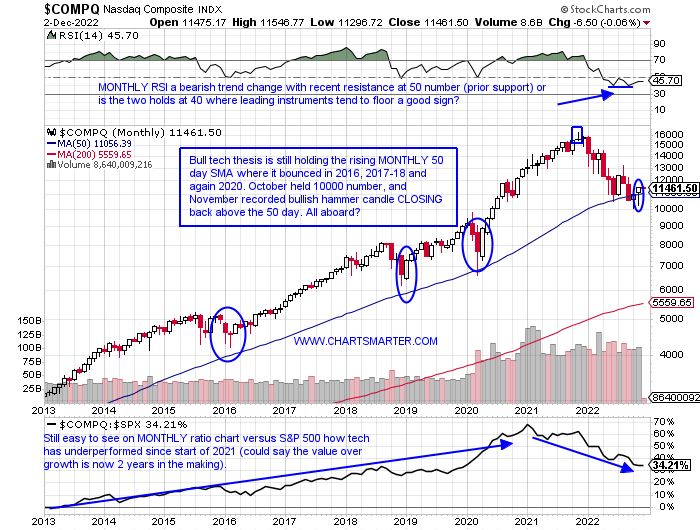

- The above quote is relevant to the markets here in the last third of the sentence. Of course, there is no guarantee that the bear market action is over, but one has to be open-minded that their negative bias may be incorrect going forward. Below is the MONTHLY chart of the Nasdaq and with November ending this past Thursday and providing a MONTHLY candle, it suggests that a new "growth" phase could be upon us. At least good risk/reward exists with the CLOSE back above its upward-sloping 50-day SMA which has signaled the end of drawdowns three times prior dating back to 2016 after bullish MONTHLY candles were recorded. The range top to bottom for the Nasdaq in November was 12% and it CLOSED less than 25 handles from the highs. The bearish gravestone doji recorded in November 2021 warranted caution and could this November's hammer propose risk is back on? Time will tell.

The Missing Piece?

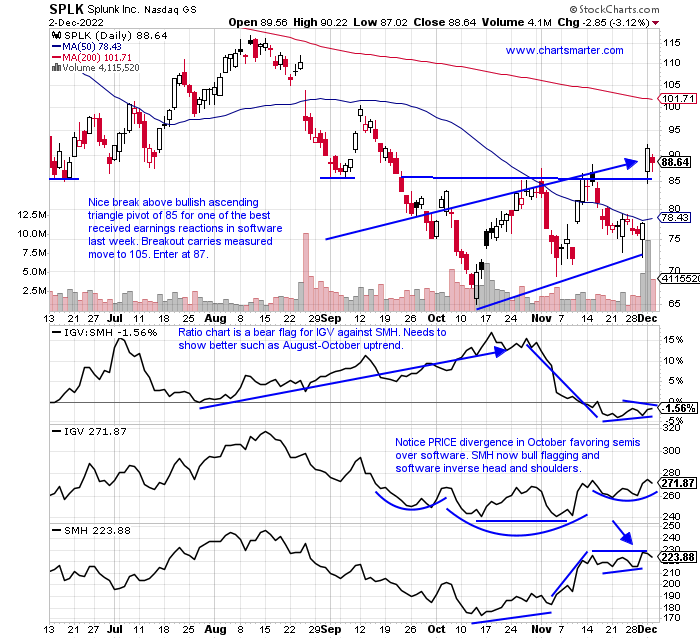

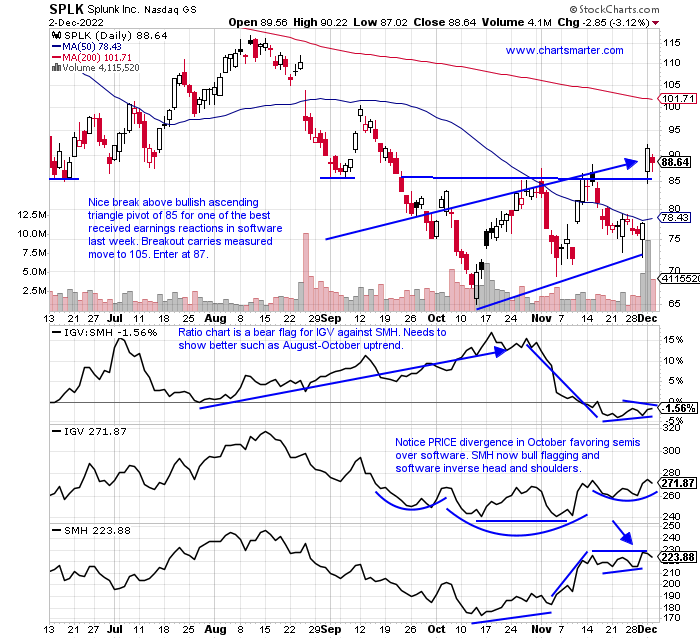

- If the bullish tech theme above is to play out the inclusion of software will be greatly appreciated if not needed. We know the semis had a stellar November as over the last month period the SMH jumped 21%. Over the same time period, the IGV is higher by "just" 8%. There was a bevy of earnings this week (CRWD INTU WDAY SNOW CRM OKTA ESTC ZS VEEN ASAN) and in my opinion, the chart below was the best received and has the best technical look. It is the only name in the bunch that made higher lows in October-November with the exception of VEEV, which Friday filled in a gap almost to the penny from the 11/9 session. For SPLK the 85 level was supported dating back to June. Most likely the group's success or failure will come down to the action in the largest holding in the IGV in MSFT. Last week broke above a bullish inverse head and shoulders pivot of 250 which gives it a measured move to 287. Its Azure issues, like AMZN AWS, are well known and perhaps the worst is behind it.

Media Foolishness:

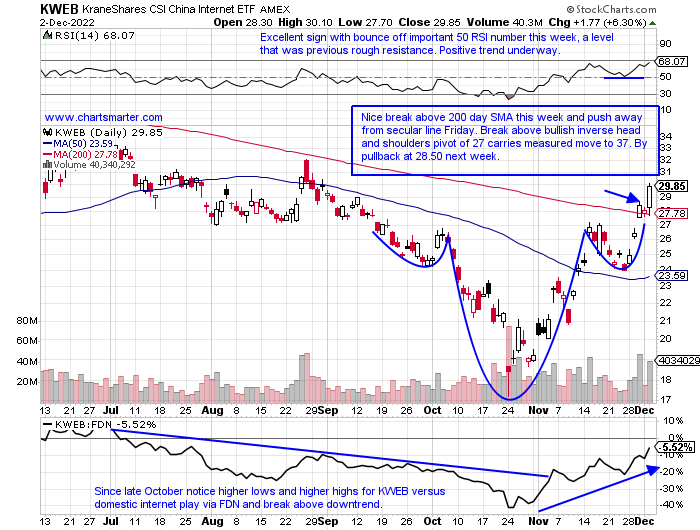

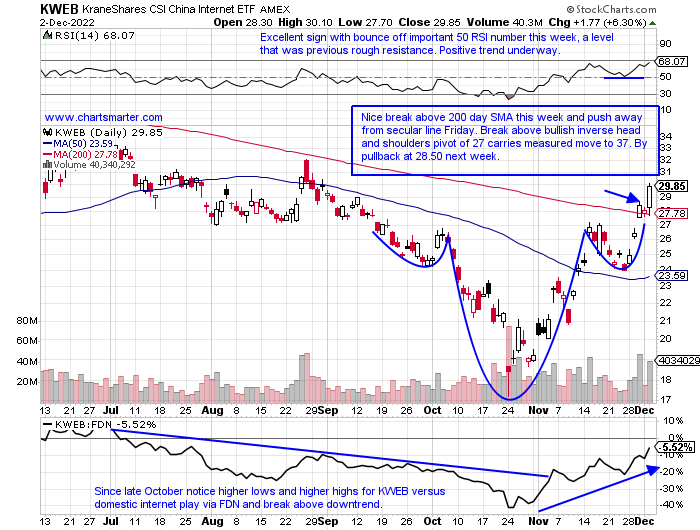

- With the inflation-driven rally Wednesday and the jobs report Friday this past week on Monday, which feels like a month ago, an interesting headline was blamed for the market's soft start to the week. The China unrest over COVID lockdowns was seen as a potential problem for the global supply chain. As the Nasdaq and S&P 500 slipped in the 1.5% neighborhood KWEB jumped 4%. Perhaps that divergence was some foreshadowing of strength the rest of the week as the Chinese internet fund gained more than 24%. The creme rises to the top with the leaders inside the ETF shining bright. A couple of weeks ago we highlighted PDD and last week it scored a 31% advance compared to BABA and JD higher by 19% (laggard NTES rose "only" 8%). KWEB is a long way from highs achieved at the very round par number in early 2021 but this recent reclaim of the 200-day SMA suggests a strong year-end run and beyond could be on tap. Notice the 50-day SMA is starting to curl higher too. Use a stop of 24.

New Issue Litmus Test?

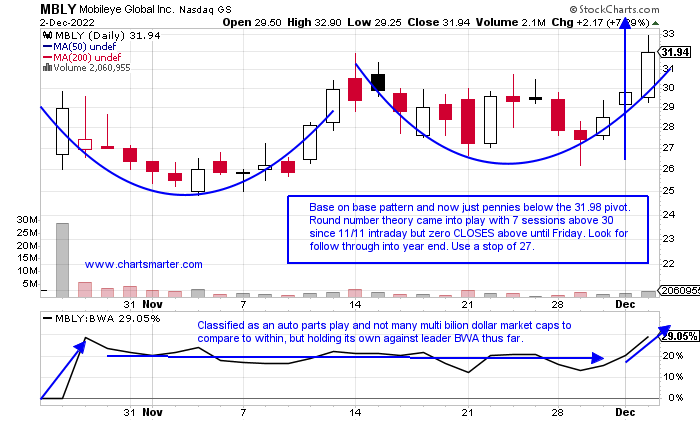

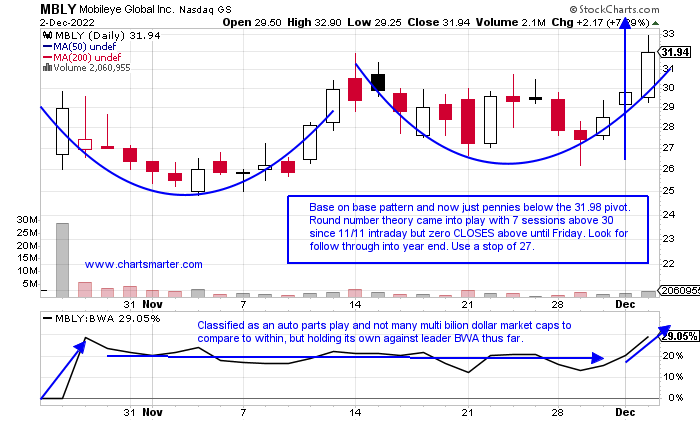

- There is no question, and rightfully so, that many high-profile names were scheduled to come public in 2022 but shelved the plans due to "market conditions". Looking at a few in the top 10 valuations to pull them were Stripe, Instacart, DataBricks, and Discord (interesting that they are all located in San Francisco of course where most private equity is based). Below is the chart of the only one in the top 5 to actually go public in MBLY which INTC spun off (not technically a new issue). But could this autonomous driving play be a guinea pig for things to come in a possible wave of IPOs in 2023? Remember this is often seen as "risk-on" behavior in markets and can help growth. The chart has only been trading for 6 weeks making it prone to volatile, immature moves but technically is doing some things right already. Add to that its chairman Pat Gelsinger is buying stock. PRICE action is all that matters and this one is off to a good start, and if it can prosper may give confidence to those aforementioned names that sat on the sidelines this year.

Biotech Vigor:

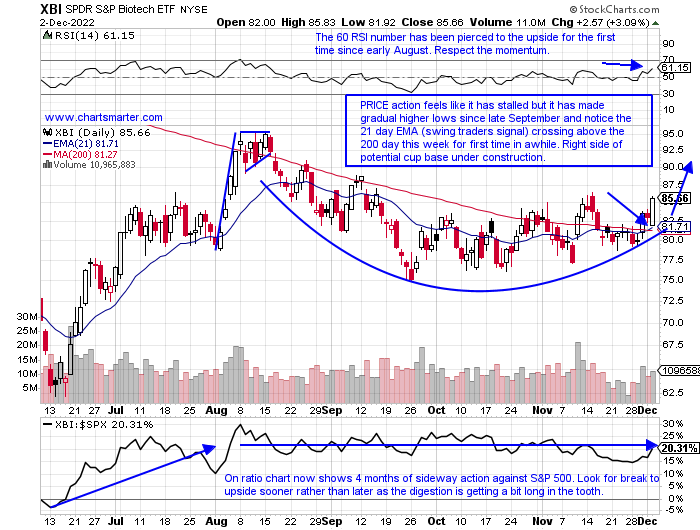

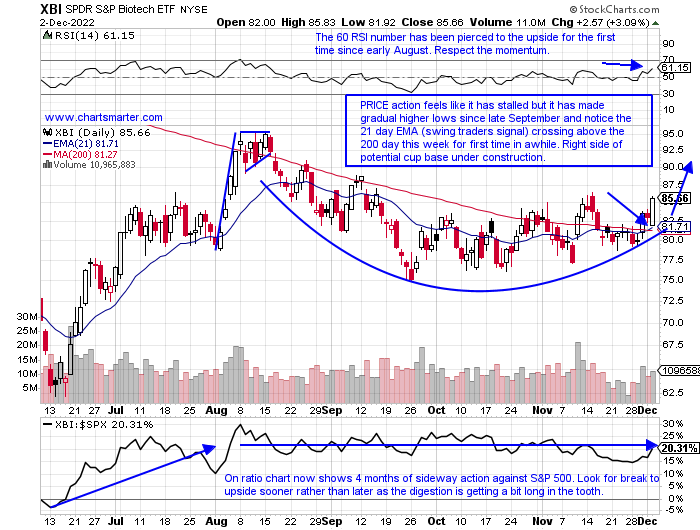

- The biotech space via the XBI witnessed a 53% run top to bottom of a range between mid-June and mid-July. The ETF then formed a bull flag continuation pattern at 95 that was taken out to the downside and the PRICE action was swift going south, as we know from FALSE moves come fast ones in the OPPOSITE direction. Recently it has shown signs that it is ready for greener pastures as this week it recaptured its 200-day SMA for the third time since late October. There have been some solid individual performances with the group with HZNP exploding 34% higher this week on takeover chatter (MRTX too). AXSM registered a similar move up 35%, and one must be careful on these types of moves as the easy money has been made and if they are not bought it could end up being an SGEN situation which is now basically back to where it was before the MRK rumor surfaced. But overall the group is healthy and GILD is now on a nine-week winning streak and names like HALO are on a 10-session win streak. Looking at the chart below of the XBI as long as the fund remains above the round 80 number one should keep long exposure on. Let's also take a look at two attractive names within to end this note.

Alnylam Pharmaceuticals:

- Biotech play up 38% YTD and 28% over last one year period.

- Name just 1% off most recent 52-week highs and has advanced 6 of last 7 weeks with this week jumping 10.2%, nearly doubling that of XBI. Nearing highs from 2 weeks ending between 8/5-12 that screamed higher by a combined 61%.

- Earnings mostly lower off 3.5, 7.6, and .4% on 10/27, 4/28, and 2/10 and rose 1.1% on 7/28.

- Enter with buy stop above cup base pivot.

- Entry ALNY 236.90. Stop 219.

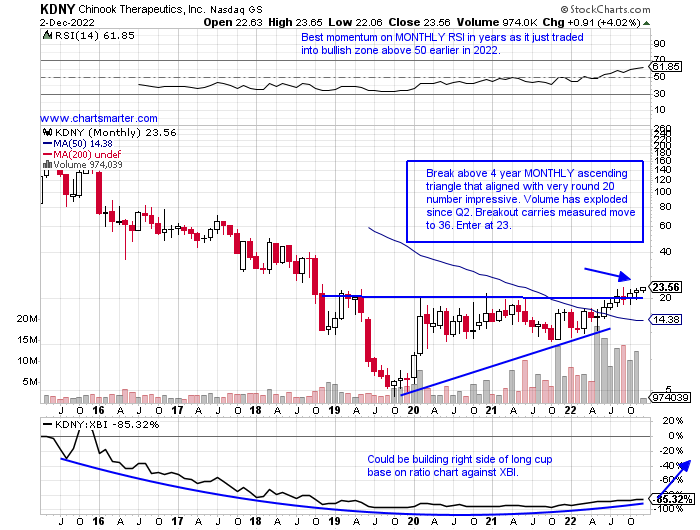

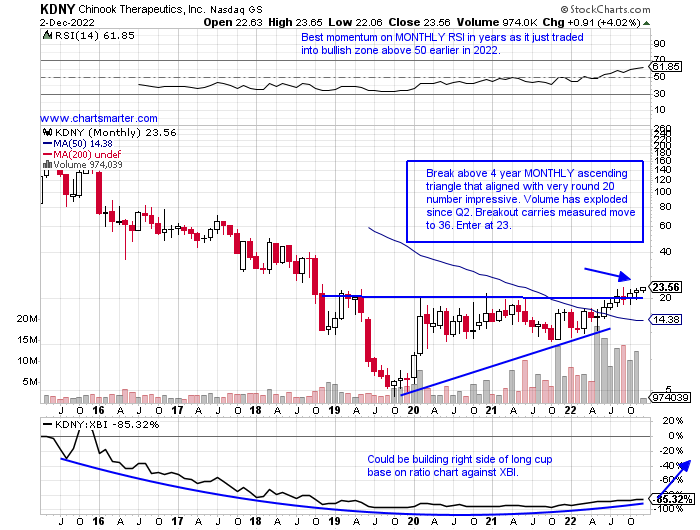

Chinook Therapeutics:

- Biotech play 44% YTD and 50% over last one year period.

- Name 1% off multi-year highs and last week jumped 18.3% ending prior 4-week losing streak. Very round 20 number has been rough support on WEEKLY chart since summer, a level of former resistance dating back to 2019.

- Earnings mostly lower off 4, 4.9, and 1.2% on 11/11, 8/9, and 5/12 and rose 8.3% on 3/18.

- Enter after MONTHLY break above bullish ascending triangle.

- Entry KDNY 23. Stop 19.50.

Good luck.

This article requires a Chartsmarter membership. Please click here to join.

"In the end, only three things matter: how much you loved, how gently you lived, and how gracefully you let go of the things not meant for you." Jack Kornfield

Nasdaq Charm:

- The above quote is relevant to the markets here in the last third of the sentence. Of course, there is no guarantee that the bear market action is over, but one has to be open-minded that their negative bias may be incorrect going forward. Below is the MONTHLY chart of the Nasdaq and with November ending this past Thursday and providing a MONTHLY candle, it suggests that a new "growth" phase could be upon us. At least good risk/reward exists with the CLOSE back above its upward-sloping 50-day SMA which has signaled the end of drawdowns three times prior dating back to 2016 after bullish MONTHLY candles were recorded. The range top to bottom for the Nasdaq in November was 12% and it CLOSED less than 25 handles from the highs. The bearish gravestone doji recorded in November 2021 warranted caution and could this November's hammer propose risk is back on? Time will tell.

The Missing Piece?

- If the bullish tech theme above is to play out the inclusion of software will be greatly appreciated if not needed. We know the semis had a stellar November as over the last month period the SMH jumped 21%. Over the same time period, the IGV is higher by "just" 8%. There was a bevy of earnings this week (CRWD INTU WDAY SNOW CRM OKTA ESTC ZS VEEN ASAN) and in my opinion, the chart below was the best received and has the best technical look. It is the only name in the bunch that made higher lows in October-November with the exception of VEEV, which Friday filled in a gap almost to the penny from the 11/9 session. For SPLK the 85 level was supported dating back to June. Most likely the group's success or failure will come down to the action in the largest holding in the IGV in MSFT. Last week broke above a bullish inverse head and shoulders pivot of 250 which gives it a measured move to 287. Its Azure issues, like AMZN AWS, are well known and perhaps the worst is behind it.

Media Foolishness:

- With the inflation-driven rally Wednesday and the jobs report Friday this past week on Monday, which feels like a month ago, an interesting headline was blamed for the market's soft start to the week. The China unrest over COVID lockdowns was seen as a potential problem for the global supply chain. As the Nasdaq and S&P 500 slipped in the 1.5% neighborhood KWEB jumped 4%. Perhaps that divergence was some foreshadowing of strength the rest of the week as the Chinese internet fund gained more than 24%. The creme rises to the top with the leaders inside the ETF shining bright. A couple of weeks ago we highlighted PDD and last week it scored a 31% advance compared to BABA and JD higher by 19% (laggard NTES rose "only" 8%). KWEB is a long way from highs achieved at the very round par number in early 2021 but this recent reclaim of the 200-day SMA suggests a strong year-end run and beyond could be on tap. Notice the 50-day SMA is starting to curl higher too. Use a stop of 24.

New Issue Litmus Test?

- There is no question, and rightfully so, that many high-profile names were scheduled to come public in 2022 but shelved the plans due to "market conditions". Looking at a few in the top 10 valuations to pull them were Stripe, Instacart, DataBricks, and Discord (interesting that they are all located in San Francisco of course where most private equity is based). Below is the chart of the only one in the top 5 to actually go public in MBLY which INTC spun off (not technically a new issue). But could this autonomous driving play be a guinea pig for things to come in a possible wave of IPOs in 2023? Remember this is often seen as "risk-on" behavior in markets and can help growth. The chart has only been trading for 6 weeks making it prone to volatile, immature moves but technically is doing some things right already. Add to that its chairman Pat Gelsinger is buying stock. PRICE action is all that matters and this one is off to a good start, and if it can prosper may give confidence to those aforementioned names that sat on the sidelines this year.

Biotech Vigor:

- The biotech space via the XBI witnessed a 53% run top to bottom of a range between mid-June and mid-July. The ETF then formed a bull flag continuation pattern at 95 that was taken out to the downside and the PRICE action was swift going south, as we know from FALSE moves come fast ones in the OPPOSITE direction. Recently it has shown signs that it is ready for greener pastures as this week it recaptured its 200-day SMA for the third time since late October. There have been some solid individual performances with the group with HZNP exploding 34% higher this week on takeover chatter (MRTX too). AXSM registered a similar move up 35%, and one must be careful on these types of moves as the easy money has been made and if they are not bought it could end up being an SGEN situation which is now basically back to where it was before the MRK rumor surfaced. But overall the group is healthy and GILD is now on a nine-week winning streak and names like HALO are on a 10-session win streak. Looking at the chart below of the XBI as long as the fund remains above the round 80 number one should keep long exposure on. Let's also take a look at two attractive names within to end this note.

Alnylam Pharmaceuticals:

- Biotech play up 38% YTD and 28% over last one year period.

- Name just 1% off most recent 52-week highs and has advanced 6 of last 7 weeks with this week jumping 10.2%, nearly doubling that of XBI. Nearing highs from 2 weeks ending between 8/5-12 that screamed higher by a combined 61%.

- Earnings mostly lower off 3.5, 7.6, and .4% on 10/27, 4/28, and 2/10 and rose 1.1% on 7/28.

- Enter with buy stop above cup base pivot.

- Entry ALNY 236.90. Stop 219.

Chinook Therapeutics:

- Biotech play 44% YTD and 50% over last one year period.

- Name 1% off multi-year highs and last week jumped 18.3% ending prior 4-week losing streak. Very round 20 number has been rough support on WEEKLY chart since summer, a level of former resistance dating back to 2019.

- Earnings mostly lower off 4, 4.9, and 1.2% on 11/11, 8/9, and 5/12 and rose 8.3% on 3/18.

- Enter after MONTHLY break above bullish ascending triangle.

- Entry KDNY 23. Stop 19.50.

Good luck.