Industrial Purpose:

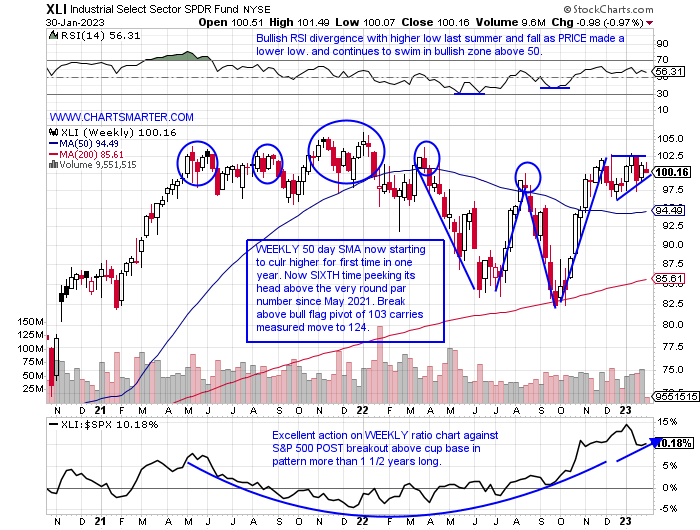

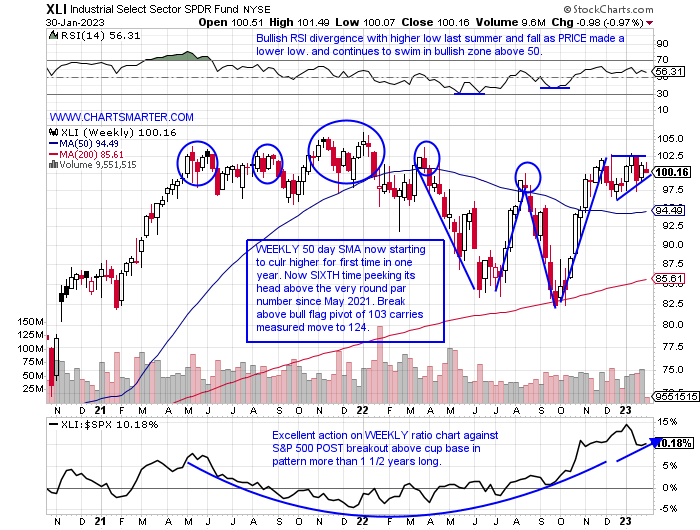

- As the industrial group treads water to begin 2023 up 2%, making it just the seventh-best major S&P sector out of 11, perhaps it is just taking a well-deserved breather before its next leg up. The chart of the XLI below shows just sticky the very round par number has been dating back to Q2 '21. Airlines and transportation services continue to be the best actors with the JETS now recording 3 straight WEEKLY CLOSES above the very round 20 number and they each CLOSED very tautly, all within just .13 of each other and we know breakouts from that type of tight consolidation can be very powerful. DAL is my favorite name there with a bull flag that aligns with the round 40 number. Lagging groups continue to be defense and railroads. The Canadian rails in CNI and CP are acting better than our domestic ones in UNP and CSX. One exception in the defense space is AXON which Monday attempted to break above a cup base pivot of 193.95 but reversed near the very round 200 number.

Less Turbulence:

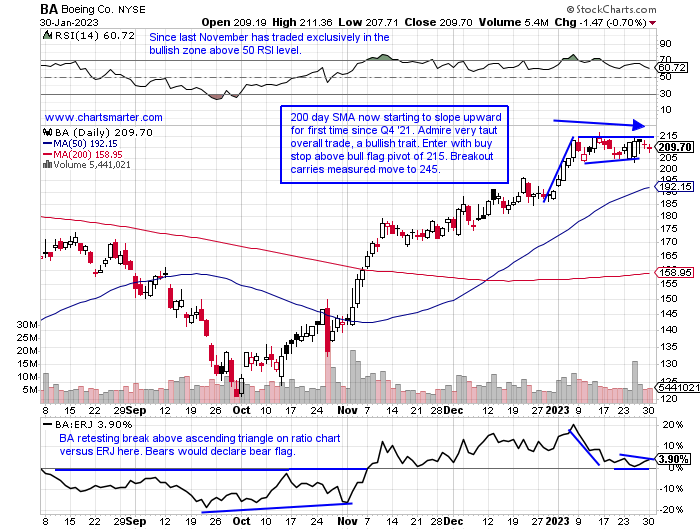

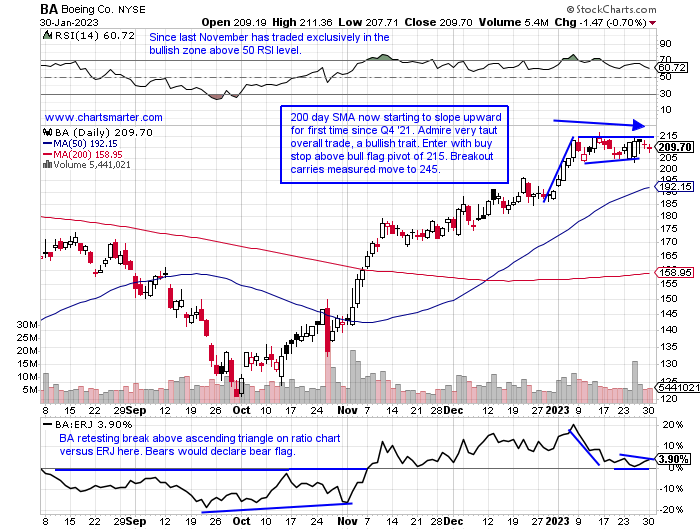

- Plenty of controversies have surrounded Beoing over the years, but the chart itself looks like a smooth takeoff since the lows last September. In fact, the stock has advanced 14 of the last 17 weeks and 2 of the 3 WEEKLY decliners CLOSED in the middle of the WEEKLY range and none lost more than 3.5%. Volume trends have been positive with accumulation weeks ending 11/4 and 11/11 both jumping by 11% in above-average WEEKLY trade. It has gained 100 handles from those lows to start Q4 '22 and is now trading sideways in a taut manner forming a bull flag. Other names acting well include Bombardier (BDRBF) which is higher in 15 of the last 17 weeks and ERJ. It has gained 6 of the last 7 weeks although the last 2 CLOSED near lows for the WEEKLY range, its daily chart looks like it has room back to the 12 area which was a cup base breakout in a 6-month pattern. I think the name has room to the high teens in the 19 area which it achieved in October '21. In my opinion, the best technical look continues to be BA, and be patient here as the entry is still 3% away.

Recent Examples:

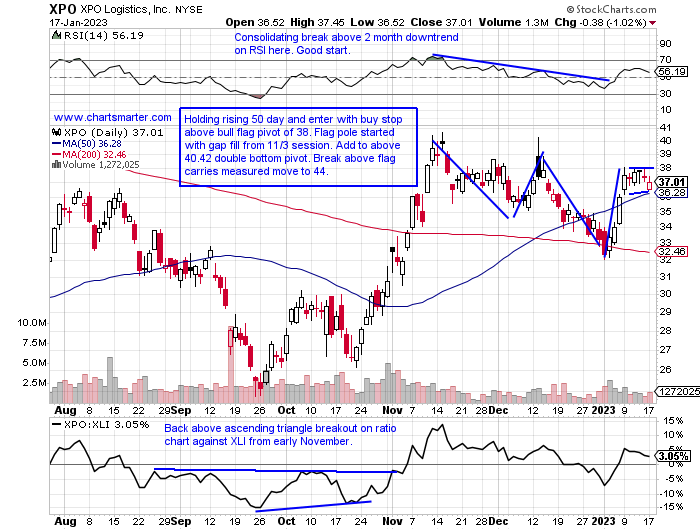

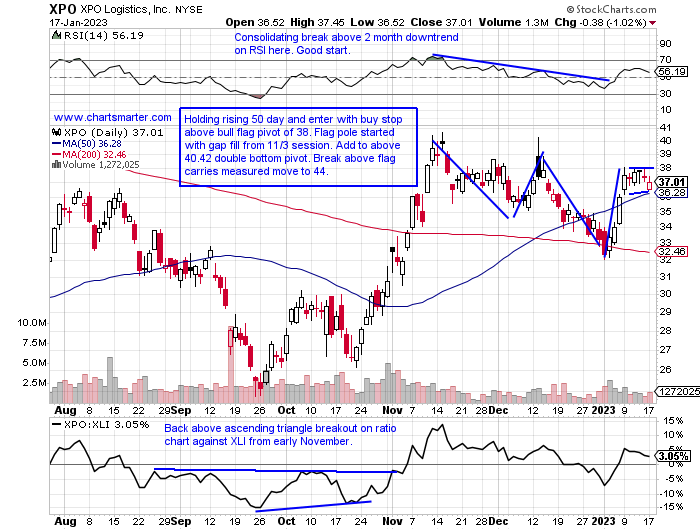

- The logistics and freight plays have been trying to make some meaningful push higher in 2023. JBHT is now 15% off most recent 52-week highs although it does seem to hesitate each time it approaches the very round 200 number from last summer and December and again this month. EXPD has been a bit soft after failing to CLOSE above a bull flag pivot above 117 on 12/13. A move back to the very round par number could set up a decent-looking double-bottom base. CHRW which REPORTS this Wednesday after the close has been stuck in a tight range between the round 90 and 100 numbers since late last September. Below is the chart of peer XPO and how it appeared in our 1/18 Industrial Note. It too has been affected by round number theory at the 40 level with 4 sessions since 11/11 above intraday but all four could not CLOSE above it. If that does come to an end look to add to above a double bottom pivot of 40.42.

Special Situations:

Mastec:

- Heavy construction play up 13% YTD and over last one year period.

- Name 2% off most recent 52-week highs and last week of October broke above WEEKLY downtrend that began in summer of '21. Week ending 1/6 broke above WEEKLY bull flag as well.

- Three straight positive earnings reactions up 17.2, 1.3, and 3.5% on 11/4, 8/5, and 5/6 after a loss of 13.1% on 2/25.

- Enter with buy stop above bull flag pivot.

- Entry MTZ 98.25. Stop 94.

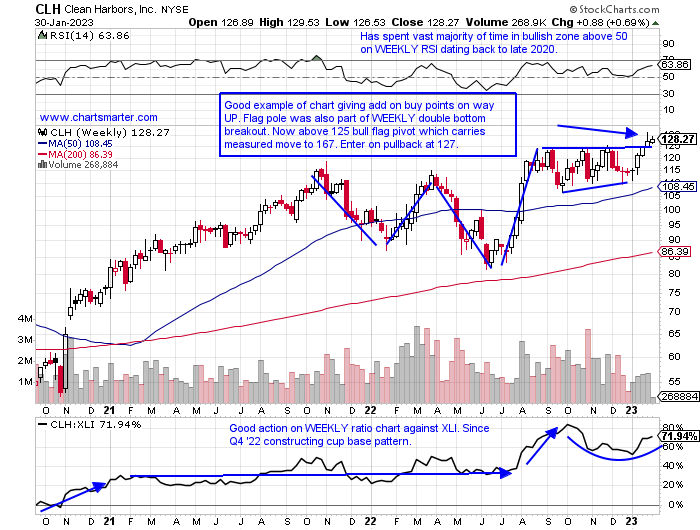

Clean Harbors:

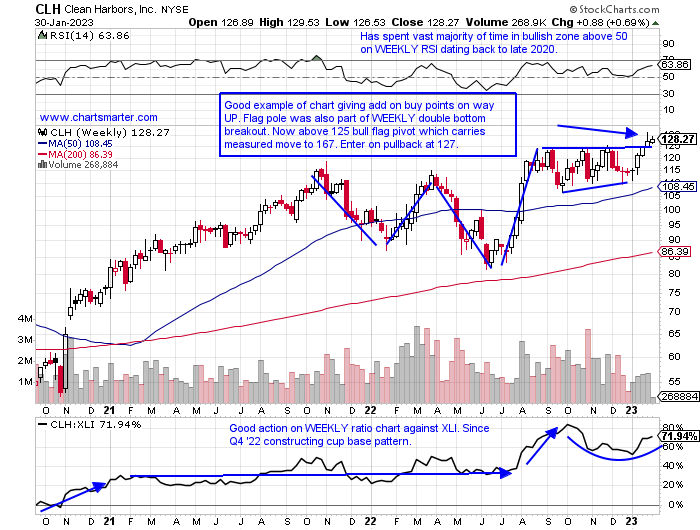

- Waste play up 13% YTD and 41% over last one year period.

- Name 2% off most recent 52-week highs and great digestion for 5 months after powerful 4-week win streak weeks ending between 7/22-8/12 that rose by a combined 33%, and this month breaking higher a very good sign.

- Earnings mixed up 10.1 and .1% on 8/3 and 2/23 and losses of 1.8 and 4.4% on 11/2 and 5/4.

- Enter on pullback into WEEKLY bull flag breakout.

- Entry CLH 127. Stop 119.

Scorpio Tankers:

- Marine transportation play down 15% YTD and up 239% over last one year period. Dividend yield of .9%.

- Name 20% off most recent 52-week highs and lower 5 of the last 6 weeks although last week recorded a bullish WEEKLY hammer candle. Impressively fell just 11 weeks between weeks ending 1/28-12/16/22.

- Earnings mixed up 7.5 and 4.1% on 11/1 and 4/28 and losses of 6.2 and 1.9% on 7/28 and 2/14.

- Enter after consecutive spinning top candles.

- Entry STNG here. Stop 44.

Good luck.

Entry summaries:

Buy stop above bull flag pivot MTZ 98.25. Stop 94.

Buy pullback into WEEKLY bull flag breakout CLH 127. Stop 119.

Buy after consecutive spinning top candles STNG here. Stop 44.

This article requires a Chartsmarter membership. Please click here to join.

Industrial Purpose:

- As the industrial group treads water to begin 2023 up 2%, making it just the seventh-best major S&P sector out of 11, perhaps it is just taking a well-deserved breather before its next leg up. The chart of the XLI below shows just sticky the very round par number has been dating back to Q2 '21. Airlines and transportation services continue to be the best actors with the JETS now recording 3 straight WEEKLY CLOSES above the very round 20 number and they each CLOSED very tautly, all within just .13 of each other and we know breakouts from that type of tight consolidation can be very powerful. DAL is my favorite name there with a bull flag that aligns with the round 40 number. Lagging groups continue to be defense and railroads. The Canadian rails in CNI and CP are acting better than our domestic ones in UNP and CSX. One exception in the defense space is AXON which Monday attempted to break above a cup base pivot of 193.95 but reversed near the very round 200 number.

Less Turbulence:

- Plenty of controversies have surrounded Beoing over the years, but the chart itself looks like a smooth takeoff since the lows last September. In fact, the stock has advanced 14 of the last 17 weeks and 2 of the 3 WEEKLY decliners CLOSED in the middle of the WEEKLY range and none lost more than 3.5%. Volume trends have been positive with accumulation weeks ending 11/4 and 11/11 both jumping by 11% in above-average WEEKLY trade. It has gained 100 handles from those lows to start Q4 '22 and is now trading sideways in a taut manner forming a bull flag. Other names acting well include Bombardier (BDRBF) which is higher in 15 of the last 17 weeks and ERJ. It has gained 6 of the last 7 weeks although the last 2 CLOSED near lows for the WEEKLY range, its daily chart looks like it has room back to the 12 area which was a cup base breakout in a 6-month pattern. I think the name has room to the high teens in the 19 area which it achieved in October '21. In my opinion, the best technical look continues to be BA, and be patient here as the entry is still 3% away.

Recent Examples:

- The logistics and freight plays have been trying to make some meaningful push higher in 2023. JBHT is now 15% off most recent 52-week highs although it does seem to hesitate each time it approaches the very round 200 number from last summer and December and again this month. EXPD has been a bit soft after failing to CLOSE above a bull flag pivot above 117 on 12/13. A move back to the very round par number could set up a decent-looking double-bottom base. CHRW which REPORTS this Wednesday after the close has been stuck in a tight range between the round 90 and 100 numbers since late last September. Below is the chart of peer XPO and how it appeared in our 1/18 Industrial Note. It too has been affected by round number theory at the 40 level with 4 sessions since 11/11 above intraday but all four could not CLOSE above it. If that does come to an end look to add to above a double bottom pivot of 40.42.

Special Situations:

Mastec:

- Heavy construction play up 13% YTD and over last one year period.

- Name 2% off most recent 52-week highs and last week of October broke above WEEKLY downtrend that began in summer of '21. Week ending 1/6 broke above WEEKLY bull flag as well.

- Three straight positive earnings reactions up 17.2, 1.3, and 3.5% on 11/4, 8/5, and 5/6 after a loss of 13.1% on 2/25.

- Enter with buy stop above bull flag pivot.

- Entry MTZ 98.25. Stop 94.

Clean Harbors:

- Waste play up 13% YTD and 41% over last one year period.

- Name 2% off most recent 52-week highs and great digestion for 5 months after powerful 4-week win streak weeks ending between 7/22-8/12 that rose by a combined 33%, and this month breaking higher a very good sign.

- Earnings mixed up 10.1 and .1% on 8/3 and 2/23 and losses of 1.8 and 4.4% on 11/2 and 5/4.

- Enter on pullback into WEEKLY bull flag breakout.

- Entry CLH 127. Stop 119.

Scorpio Tankers:

- Marine transportation play down 15% YTD and up 239% over last one year period. Dividend yield of .9%.

- Name 20% off most recent 52-week highs and lower 5 of the last 6 weeks although last week recorded a bullish WEEKLY hammer candle. Impressively fell just 11 weeks between weeks ending 1/28-12/16/22.

- Earnings mixed up 7.5 and 4.1% on 11/1 and 4/28 and losses of 6.2 and 1.9% on 7/28 and 2/14.

- Enter after consecutive spinning top candles.

- Entry STNG here. Stop 44.

Good luck.

Entry summaries:

Buy stop above bull flag pivot MTZ 98.25. Stop 94.

Buy pullback into WEEKLY bull flag breakout CLH 127. Stop 119.

Buy after consecutive spinning top candles STNG here. Stop 44.