- Round number theory is one that is under followed, and not given the credit it deserves. It is a simple, yet effective tool that can help investors trim or add to core positions. The round figures often will serve as support, or a roadblock. Some round figures are more important than others. First time trading above 10 can give a stock a boost, as some mutual funds are not permitted to own single digit names. The 90 number is very important, as many studies have shown that the first time a stock trades through that level it very often trades to par and beyond. Highly visible examples were Bitcoin reversing at 20,000, or TLRY at 300, and of course the S&P 500 now at 3000. Whether the reason that round number theory works is psychological or not, it does not matter. Follow PRICE action first and foremost. Below let us take a look at some more examples.

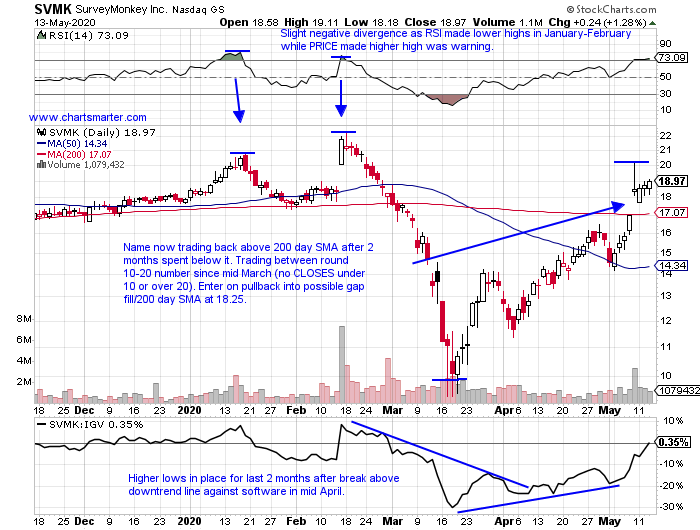

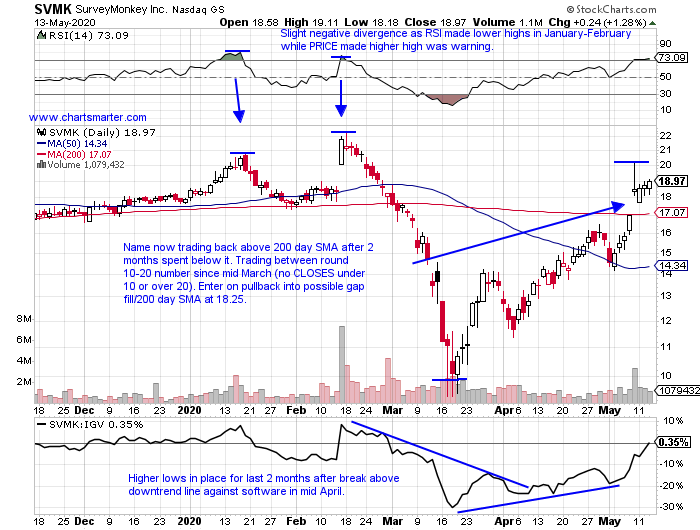

In our Wednesday 5/20 Tech Note we looked at SVMK.

- Round number theory has been a thorn in the side of the chart below of SVMK, and how it appeared in our 5/14 Technology Note. The suggested entry of 18.25 has not been triggered, and we are all about patience here, and looking for select ideas. I think this pivot may still be in play, as Monday reversed at the very round 20 figure, just as it did on 5/8, even after a WFC upgrade this morning. Volume has perked up recently, and it is now on a 14 of 18 session winning streak too. Keep in mind if this name can CLOSE above the 20 number on a WEEKLY basis, it would be a break above the bullish ascending triangle pattern that began the first week it began trading back in September of 2018. This play was a victim of the recent big selloff, as it did break above the 20 number the week ending 2/14 jumping 17.7%, before succumbing like nearly every other stock. Look for a CLOSE above the 20 number is how to look at this one going forward. It has been above 20 everyday this week on an intrday basis but has been unable to CLOSE above it.

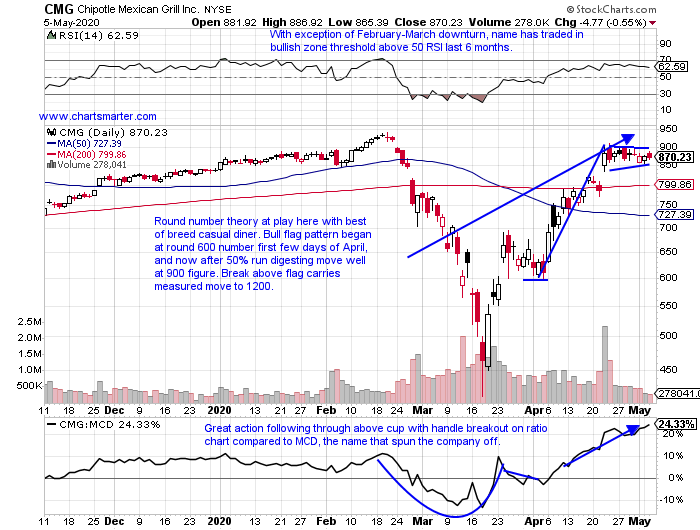

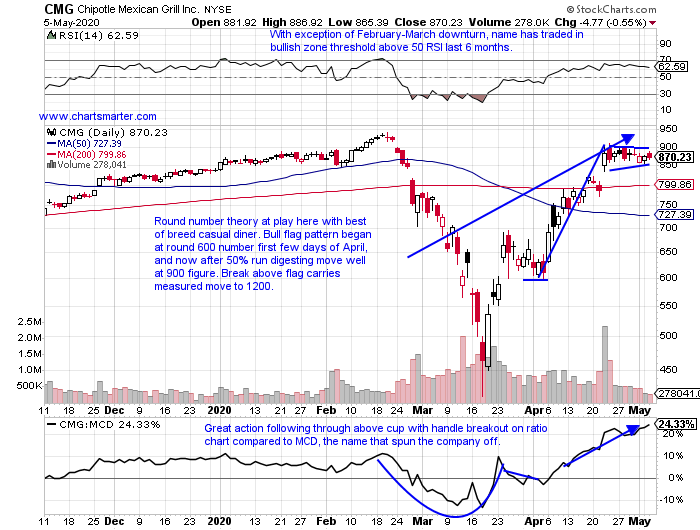

In our 5/6 Consumer Note we looked at CMG.

- Last week I wrote a poll on TWTR, which name would be the first to break above 1000, Chipotle or Tesla. TSLA won the poll, but lets take a look at the chart below of CMG, may be the better pick to get to the 1000 number, IF it can break above the 900 number which has been stubborn resistance within a bull flag formation. The casual diner space has a few generals inside the group with WING and DPZ also trading in the single digits off their most recent 52 week/all time highs. CMG has more than doubled off lows made just this March, and looks poised for a big, imminent move out of this very taut consolidation. Name nearly hit the round 1100 number Tuesday, and also recorded a bearish engulfing candle, and now trades right near very round 1000 number.

In our 5/6 Healthcare Note we looked at ARWR.

- Biotech play lower by 48% YTD, and higher by 32% over last one year period.

- Has lost ground 13 of the last 15 weeks, and 14 of them CLOSED in the lower half of weekly range, and now trades 70% off most recent 52 week highs.

- Last earnings reaction that fell 6% on 2/6 ended FOUR straight positive gains that rose 18.8, 4.6, 6.1 and 17.7% on 11/26, 8/6, 5/9 and 2/8/19.

- Enter after successful retest of WEEKLY cup with handle breakout.

- Entry ARWR here. Stop 19.25. Stock now trading near 33, and in a range between 30-40 since April.

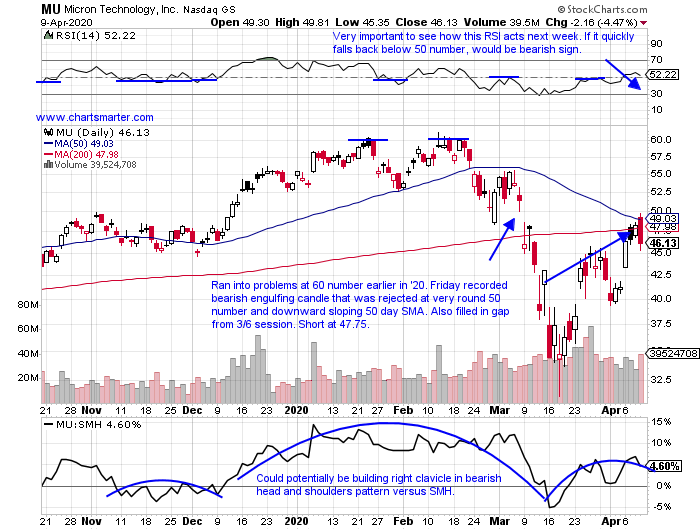

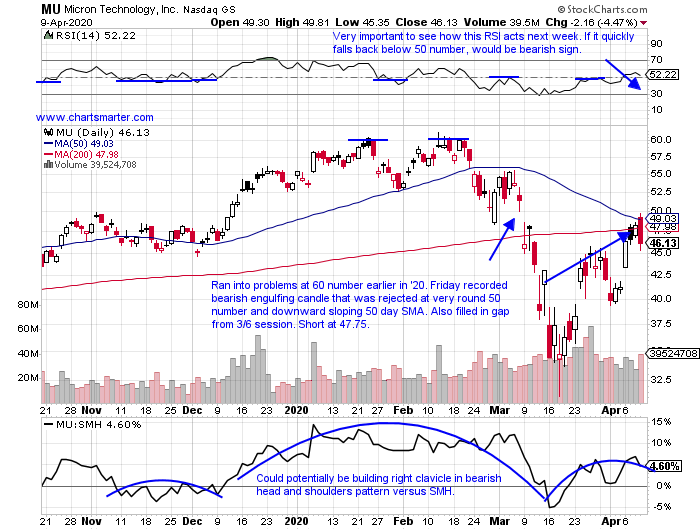

In our 4/20 Technology Note we looked at MU.

- We hear all the time how everything we purchase is inundated with semiconductors. They are seemingly ubiquitous. Therefore investors want to see this group participate resoundingly in any rally. Below is the chart of a former best of breed name in MU, and how it appeared in our 4/13 Technology Note. It does not garner the same clout as it once did, as it still trades 25% off most recent 52 week highs. Micron we noticed recorded a bearish engulfing candle at the very round 50 number (for the last 2 years has been trading roughly between the round 30-60 figures) on 4/9, and has been unable to break back above it. The last 3 weeks have CLOSED in the lower half of the WEEKLY range, and displayed poor relative strength this week falling fractionally, while the SMH rose almost 7%. In this specific space there are better places to place your capital. Currently it met resistance once again at the 50 number in late April and again this week. Time will tell if that is just temporary.

In our 4/22 Consumer Note we looked at LEVI.

- Iconic brand denim name lower by 29% YTD and 38% over last one year period. Dividend yield of 2.3%.

- Week ending 4/10 screamed up by 44.9% in best WEEKLY volume since week ending 10/11/19. Still 43% off most recent 52 week highs.

- Last earnings reaction rose by 9.3% on 4/8, ending a streak of three straight losses of .6, 7.5 and 12% on 1/31, 10/9 and 7/10/19.

- Enter on pullback into bullish morning star pattern.

- Entry LEVI 11.25. Stop 9.50. Stock was down nearly 7% Thursday, and now trading at 13.63.

This article requires a Chartsmarter membership. Please click here to join.

- Round number theory is one that is under followed, and not given the credit it deserves. It is a simple, yet effective tool that can help investors trim or add to core positions. The round figures often will serve as support, or a roadblock. Some round figures are more important than others. First time trading above 10 can give a stock a boost, as some mutual funds are not permitted to own single digit names. The 90 number is very important, as many studies have shown that the first time a stock trades through that level it very often trades to par and beyond. Highly visible examples were Bitcoin reversing at 20,000, or TLRY at 300, and of course the S&P 500 now at 3000. Whether the reason that round number theory works is psychological or not, it does not matter. Follow PRICE action first and foremost. Below let us take a look at some more examples.

In our Wednesday 5/20 Tech Note we looked at SVMK.

- Round number theory has been a thorn in the side of the chart below of SVMK, and how it appeared in our 5/14 Technology Note. The suggested entry of 18.25 has not been triggered, and we are all about patience here, and looking for select ideas. I think this pivot may still be in play, as Monday reversed at the very round 20 figure, just as it did on 5/8, even after a WFC upgrade this morning. Volume has perked up recently, and it is now on a 14 of 18 session winning streak too. Keep in mind if this name can CLOSE above the 20 number on a WEEKLY basis, it would be a break above the bullish ascending triangle pattern that began the first week it began trading back in September of 2018. This play was a victim of the recent big selloff, as it did break above the 20 number the week ending 2/14 jumping 17.7%, before succumbing like nearly every other stock. Look for a CLOSE above the 20 number is how to look at this one going forward. It has been above 20 everyday this week on an intrday basis but has been unable to CLOSE above it.

In our 5/6 Consumer Note we looked at CMG.

- Last week I wrote a poll on TWTR, which name would be the first to break above 1000, Chipotle or Tesla. TSLA won the poll, but lets take a look at the chart below of CMG, may be the better pick to get to the 1000 number, IF it can break above the 900 number which has been stubborn resistance within a bull flag formation. The casual diner space has a few generals inside the group with WING and DPZ also trading in the single digits off their most recent 52 week/all time highs. CMG has more than doubled off lows made just this March, and looks poised for a big, imminent move out of this very taut consolidation. Name nearly hit the round 1100 number Tuesday, and also recorded a bearish engulfing candle, and now trades right near very round 1000 number.

In our 5/6 Healthcare Note we looked at ARWR.

- Biotech play lower by 48% YTD, and higher by 32% over last one year period.

- Has lost ground 13 of the last 15 weeks, and 14 of them CLOSED in the lower half of weekly range, and now trades 70% off most recent 52 week highs.

- Last earnings reaction that fell 6% on 2/6 ended FOUR straight positive gains that rose 18.8, 4.6, 6.1 and 17.7% on 11/26, 8/6, 5/9 and 2/8/19.

- Enter after successful retest of WEEKLY cup with handle breakout.

- Entry ARWR here. Stop 19.25. Stock now trading near 33, and in a range between 30-40 since April.

In our 4/20 Technology Note we looked at MU.

- We hear all the time how everything we purchase is inundated with semiconductors. They are seemingly ubiquitous. Therefore investors want to see this group participate resoundingly in any rally. Below is the chart of a former best of breed name in MU, and how it appeared in our 4/13 Technology Note. It does not garner the same clout as it once did, as it still trades 25% off most recent 52 week highs. Micron we noticed recorded a bearish engulfing candle at the very round 50 number (for the last 2 years has been trading roughly between the round 30-60 figures) on 4/9, and has been unable to break back above it. The last 3 weeks have CLOSED in the lower half of the WEEKLY range, and displayed poor relative strength this week falling fractionally, while the SMH rose almost 7%. In this specific space there are better places to place your capital. Currently it met resistance once again at the 50 number in late April and again this week. Time will tell if that is just temporary.

In our 4/22 Consumer Note we looked at LEVI.

- Iconic brand denim name lower by 29% YTD and 38% over last one year period. Dividend yield of 2.3%.

- Week ending 4/10 screamed up by 44.9% in best WEEKLY volume since week ending 10/11/19. Still 43% off most recent 52 week highs.

- Last earnings reaction rose by 9.3% on 4/8, ending a streak of three straight losses of .6, 7.5 and 12% on 1/31, 10/9 and 7/10/19.

- Enter on pullback into bullish morning star pattern.

- Entry LEVI 11.25. Stop 9.50. Stock was down nearly 7% Thursday, and now trading at 13.63.